Executive Summary

The report below explains the nature and background of financial markets in the UK and the US. It also briefs about the relationship between the UK financial markets and the US. The UK is a significant contributor to the development of financial markets globally since it hosts the most significant number of financial markets. Conversely, the US markets also contribute to the global expansion of the financial markets since they host the most important number of stock exchange firms. Besides the financial markets, the manufacturing industry affects the economy by aiding international trade between countries.

Competitive advantage creates a difference between the two countries because one has to supply the most economical commodity. The report also highlights the economic recovery journey of the US, which grew by a 7% GDP increase in the last quarter of 2021. It also discusses how economic policies and decisions affect the economy and tradeoffs between partnering countries. Investors should inquire about how the financial markets operate and understand how competitive advantage may support their operations.

Introduction

Lombard Odier is among the best financial investment companies in the UK. The United Kingdom is the largest financial market globally and controls the most extensive foreign exchange market (Dell’Ariccia, Rabanal & Sandri, 2018. p.157). It is the domestic market of choice because it has a long lifeline in the industry and serves a broad customer base. UK’s financial markets contribute anonymously to the financial markets by hosting one of the three command centers in the world London. London has some of the largest stock exchange companies that trade with key multinational giants like Japan, the USA, and French oil and gas. United Kingdom’s financial market has a strong foundation, having served since the 16th Century. Therefore, the United Kingdom’s financial market is the most suitable market for this report to serve as the domestic market.

On the other hand, the United States market is the best suitable market to use as the international market in this report because it is also stable. The US economy is among the largest global gross domestic product and hosts many financial market companies. The United States financial market hosts most of the stock exchange companies. The US dollar is also a stable currency hence effective in monetary trades. The United States market has various investment choices since many investors are competing. High competition increases innovation leading to an increased need for different financial investment markets. The US is also secure and has higher opportunities for a broader class of investors.

Background of Financial Markets

Financial markets are forms of trade that deal with buying and selling financial assets. These financial assets include the stock markets, over-the-counter markets, bond markets, money markets, derivatives markets, forex markets, and commodities markets. The financial markets facilitate smooth operation in capitalistic economies by allocating resources and creating liquidity for businesses and investors (Dean et al., 2020, p. 1). Financial markets make it easy to trade financial holdings because they vary through the market. The government mandates the central bank the duties to create money. The central bank then distributes the money to the investors and other citizens using open market operations. Open market operations are government securities that the government uses to increase or reduce the money supply in the economy. The government uses expansionary and contractionary monetary policies to regulate the amount of money in the economy.

Capital markets are long-term debt investments meant to buy and sell securities to control the amount of money in an economy. Conversely, money markets are short-term debt investments that hold the money supply by buying and selling securities like bonds and shares. Banks also contribute to the amount of money supply in an economy. Lending money increases the economy’s amount by making borrowers hold more capital. Banks may also regulate the money supply for investors by reducing their lending amount. Discouraging borrowing through increasing interest rates creates a weak borrowing culture, thus decreasing the amount of money available for society.

The US government is vigilant in ensuring that there are well-founded laws and regulations that support international trade and maintain local businesses. Inflation and money supply work hand in hand to control the progress of the financial markets. High inflation makes debtors pay money worth less than the original value of the money when lending, thus affecting financial institutions and markets. The UK government targets an inflation rate of 2%, thus its effectiveness in maintaining the financial markets.

Capital and money markets also control money availability and inflation by the use of monetary policies. If the government wants less money, it uses contractionary monetary policies to reduce the total money supplied and expansionary monetary policies when providing money to the economy. Banks give money to the economy by collecting savings from those with excess funds and lending to those who need more money. In turn, the debtors owe the bank some interest. Banking is one of the best ways to redistribute funds from satisfied people to those who need it more.

The Ricardian Model

David Ricardo, an influential British political economist, invented the Ricardian theory of comparative advantage. He influenced classical economics and developed a hypothesis explaining the relationship between the comparative advantages concerning two countries producing two similar commodities. Ricardian theory of comparative advantage states that the causes and benefits of international trade extract the difference between the relative opportunity costs of producing the items in the two countries (Moloi and Marwala, 2020, p. 25). It is relevant under the following four assumptions; there are only two countries in existence, and the two countries produce two similar commodities, say X and Y. The other is that the participating countries have similar tastes, and the last is that labor is the only existing factor of production in the two economies. For example, suppose two countries, A and B, are producing similar commodities, Y and Y, country A has to lose two units of Y to make item X, and country B has to forgo three units of commodity Y to produce 1 unit of item X. Then, country A is better off making item X while country B produces product Y.

However, the Ricardian theory of comparative advantage has a few limitations. First, the theory assumes full employment in the two countries. It is impossible to have total employment in a country since there is always a segment of underemployment. Two countries cannot employ their population until there is zero unemployment. Another limitation is the assumption that labor is homogenous within the two countries. By assuming that labor is homogenous, the theory gains criticism. In addition, the comparative advantage theory assumes that there are no transport cost differences between the two countries. It is unlikely to find similarly located industries from the resource center in two countries. The assumption that the transport cost differences do not exist provides a wrong impression of the comparative advantage. Last, it is not reasonable for the Ricardian theory of comparative advantage to assume that there is a constant return to scales from the commodities produced. The Ricardian comparative advantage theory is unreliable in determining the country with the highest comparative advantage.

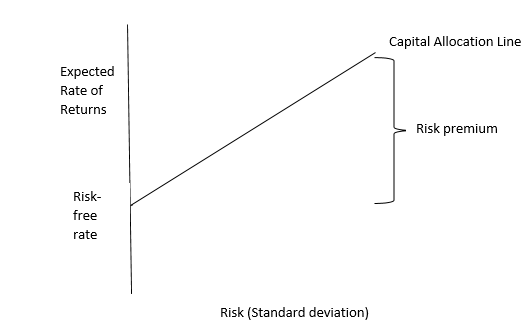

Capital Allocation in the United Kingdom

The distribution of resources in an organization is vital for the efficient flow of factors of production within it. Capital allocation is assigning financial resources to different segments of an organization or economy to gain maximum shareholder equity and profits. Capital allocation in the United Kingdom’s economy mainly focuses on agricultural, industrial, and service production sectors (Pfitzinger & Katzke, 2019. p.10). These sections of the economy are significant in ensuring the continued growth of the UK without much strain. The agricultural sector of the UK economy contributes to the economy by providing the most resources for agri-manufacturing companies. However, the capital allocation primarily lies under the service production industries since they produce the highest gross domestic product, followed by the manufacturing and agricultural sectors. There are many types of capital allocation, including; investment and organic growth, mergers and acquisitions, paying down debt, paying dividends, and share repurchases.

Investment and organic growth are a form of capital investment strategy that reinvests the gained profits in activities that boost the growth of the business. It involves investing earned capital and earnings in business projects and techniques that generate the initial idea of the business. On the other hand, mergers are when companies join forces with competitors to form a single company with a more extensive capital base and competing power. In acquisitions, a single company purchases its competing firm to create a single one. Merging and acquisition are vital for companies since it boosts the capital allocation in the business and enhances competitive power. Paying down debt also allocates capital, and it is easy to predict the future value of the money because it is mathematically generatable. Whereas paying dividends grows the investor’s capital base, share rebuying occurs when a company buys back its shares, reducing its outstanding shares. All these types of capital allocation strategies grow the capital base for more and more investments.

The Concept of Competitive Advantage

The theory of comparative advantage states that a person would sell what they can quickly produce and purchase what they find challenging to offer. The concept of comparative advantage implies that a country can create a specific item at a lower opportunity cost than its competing countries (Gaubert and Itskhoki, 2021, p.896). The idea indicates the government’s profits from producing a particular line of goods and commodities. When a country has a competitive advantage, it makes items cheaper than its trading partners. For example, Japan has a competitive advantage in the production of automobiles. Therefore, Japan has a competitive advantage in the assembly of autos compared to the United States of America. International trade is based on comparative advantage because a country would focus more on exporting cheap items for them to produce. Concentrating on areas that are cheap to produce earns more profits for the country since it sells excess products in international markets. The concept of comparative advantage assists countries in identifying the commodities they can make comfortably to achieve maximum exploitation of their resources.

Capital Allocation in the US.

Most local businesses allocate capital where the government has also given because it indicates high returns. An investor may determine a business’s return rate by reviewing the investment amount placed (Maggiori, Neiman, and Schreger, 2018). The American government encourages the domestic allocation of capital to local businesses by lowering taxation costs. It creates regulations that facilitate better trading agreements between local traders. Capital inflows into domestic industries provide jobs and support the economic growth of the country (Cielik and Goczek, 2018). The domestic economy keeps growing and eliminates poverty by creating work for locals.

Patterns of Trades in the USA

The political scenery has influenced the trade patterns in the United States of America. The national politics in 2018 saw the launch of the war on China trade that had begun to control the market tremendously. Later in 2019, the coronavirus pandemic brought the relationship between the United States and its trade partners to a standstill (Gruszczynski, 2020, p.340). The pandemic hindered the importation and exportation of the majority of commodities in the market. The pandemic halted relationships between countries lowering the total spending on the importation and exportation values in the US and many other countries. It affected international trade patterns by canceling importation and exportation from one country to another to contain the spread of the virus to the participating countries.

The impacts of COVID-19 were negative on the trading relationships between the States and its trading partners as trading of non-essential products was paused. The government policies such as the introduction of tariffs also affect trade immensely. High tariffs discourage importation from other countries. However, in 2021, the GDP grew by 7% in the last quarter compared to 2.3% in the third quarter (BEA. 2021. p. 1). Hostile government policies hinder international business growth, leading to an inclination in the level of benefits attained from participation in such trades.

Economic Policies of the USA

The United States is vigilant in ensuring that its economic policies promote the growth of international competition and economic development. The policies intended to encourage more traders to join the markets and exploit the opportunities available for trading. The United States of America’s government protects newbie traders in the market by placing economic policies that nature their growth. Low taxation rates, low regulations, low levels of unionization, and more comprehensive chances of openness to foreign trade are methods the government uses to sustain the growth of foreign exchanges. Low taxes attract new investors into the business and expand the market size (Nurov and Nurova, 2021, p. 278). They also maintain old investors since they do not transfer much of their hard-earned money to the government, thus increasing the profit margins. Low regulations facilitate entry into and exit from the market without interfering with other traders or the supply of commodities in the market. Simple economic policies promote international trade between America and other nations.

Sources of USA’s Competitive Advantage

The US has a higher competitive advantage because it has low production costs due to advancements in technology and also has highly trained personnel to control the technological equipment. Having excellent knowledge and skills to operate the machinery allows the country’s industries to save more time, thus producing more commodities within a specific timeline (Santacreu and Zhu, 2018). Electricity supply is also consistent, making production continuous and cheap. Industries also have easy access to natural resources that are vital for the production of each product. The purchasing power parity theory states that the exchange rates between two currencies are in equilibrium when their purchasing power is similar in each of the two countries. The portfolio balance theory states that the portfolio equilibrium is attained when the interest rate of pure money is equal to the pure real rate of interest plus the average in a world with two assets, a monetary asset and a real asset. These two theories affect the economy’s inflation rate and price stability. The government projects to maintain the inflation rate at low standards and still hold the prices intact.

Evaluation of USA’s Economy

The US economy has grown over the years to generate among the highest GDPs globally. According to the US census, the leading importers for items for the United States are Canada, Mexico, China, Japan, and Germany. Canada leads with an importation amount worth $307.6 billion, and Mexico follows with $276.5 billion (Census, 2021). After Mexico, China imports goods worth $151.1 billion, and Japan and South close to the top five importers list from the United States with $75.0 and $65.8 billion, respectively (Rodousakis and Solis, 2022, p.2). Germany imports goods worth $65.2 billion, and the United Kingdom, Netherlands, India, and Taiwan follow with 61.5, $ 53.6, $40.1, and $36.9 billion worth of imports, respectively.

Fig (a). A list of countries with the largest imports from the United States of America.

Critical Evaluation of Challenges the US Faces Due to Industrialization, Trade, and Policies

Industrialization is a phase that saw many industries rise to create employment and produce goods. The growth of companies has led to increased pollution within the surroundings (Ma and Wang, 2021). Pollution comprises air pollution, noise pollution, water pollution, and soil contamination. Pollution is when some companies or people release harmful waste to the environment. The release of smoke emissions into the air is has contributed to an increase in cases of breathing difficulties. Human beings inhale the smoke particles that stick in their lungs and reduce the space for oxygen uptake. Water pollution has led to increased destruction of aquatic life, such as aquatic plants and animals, due to excessive chemical compounds in the water. On the other hand, soil contamination has affected vegetation growth and resulted in land degradation (Bauer, Mezuman, and Gao, 2019, p. 4112). Industrialization has had some negativity in people’s lives despite creating employment and welfare improvement.

Despite creating employment and goods and services, trade has led to the loss of culture as people imitate their international clients’ culture. Trade has also raised conflicts between countries that do not agree on trade treaties (Moon, 2018). Enmity may lead to a civil war, is a crime, and should not have the chance to occur. Another challenge a country may face in trade is the presence of language barriers (Mizik, 2020, p 2626). Language barriers prevent a perfect transaction since people do not understand each other; thus, bargaining is limited. Currency exchange and inflation rates also occur, minimizing the profits amounts available. Geo-politicization may arise, causing a diminishment in the effectiveness of a trade. Thus, all traders should have alternative trading means if any of these events occur.

Policies in trade help regulate the number of suppliers in a market. They also control the entry of counterfeit goods into the market. However, some policies challenge firms operating within specific needs (Balistreri, Bohringer, and Rutherford, 2018). Tariffs and movement restrictions affect the prosperity of international trade negatively. For instance, movement restriction laws during the COVID-19 pandemic era brought international trade to a standstill. Another example is poor trade relationships with the Chinese government that affects the US’s trade relationship with other countries that are dependent on China. The US government should be vigilant when making treaties with its partnering countries to reduce shortcomings.

Conclusion

Government policies influence international trade by controlling the number of suppliers that reach the market. Policies also prevent the entry of counterfeit commodities into the market, protecting the residents from adversity. The US financial markets continue to gain stability with time. Its economy also continues to flourish, producing among the highest GDPs in the world. The US will outdo other countries’ instability of the financial markets because it is keen on maintaining excellent trade relationships. Additionally, the country’s economy is set to fully recover from the impact of the COVID-19 pandemic by eliminating laws that negatively affected thriving businesses during the pandemic season.

Recommendation: The firm should engage in understanding the UK’s trade policies with the US by seeking advice from legal advisers. It should gather all the relevant resources to understand how financial markets operate and how key aspects like inflation, government policies and regulations, price stability and money supply affect the prosperity of the financial markets. The firm should acknowledge the economic structure of the domestic and international markets to know the requirements for operating smoothly. Last, the firm should recognize the impact of having a competitive advantage in its operations. Knowing a competitive advantage boosts the company’s spirit and helps them identify its economic strength.

Reference List

Bauer, S.E., Im, U., Mezuman, K. and Gao, C.Y. (2019) ‘Desert dust, industrialization, and agricultural fires: Health impacts of outdoor air pollution in Africa’. Journal of Geophysical Research: Atmospheres, 124(7), pp.4104-4120. Web.

Balistreri, E.J., Böhringer, C. and Rutherford, T. (2018) Quantifying disruptive trade policies. CESifo Working Paper No. 7382. Web.

BEA. (2021). U.S.US economy at a glance. p.1. Web.

Census. (2021) Top trading partners. Web.

Cieślik, A. and Goczek, Ł. (2018) ‘Control of corruption, international investment, and economic growth–Evidence from panel data. World Development, 103, pp.323-335. Web.

Dean, E., Elardo, J., Green, M., Wilson, B. and Berger, S. (2020) ‘The Tradeoffs of Trade Policy. Principles of Economics: Scarcity and Social Provisioning (2nd ed.). Rice University. Web.

Dell’Ariccia, G., Rabanal, P., & Sandri, D. (2018). Unconventional monetary policies in the euro area, Japan, and the United Kingdom. Journal of Economic Perspectives, 32(4), 147-72. Web.

Gaubert, C. and Itskhoki, O. (2021) ‘Granular comparative advantage’, Journal of Political Economy, 129(3), pp.871-939. Web.

Gruszczynski, L. (2020) ‘The COVID-19 pandemic and international trade: Temporary turbulence or paradigm shift?’ European Journal of Risk Regulation, 11(2), pp.337-342. Web.

Ma, T. and Wang, Y. (2021) ‘Globalization and environment: Effects of international trade on emission intensity reduction of pollutants causing global and local concerns’. Journal of Environmental Management, 297, (pp.113249). Web.

Maggiori, M., Neiman, B. and Schreger, J. (2018) ‘International currencies and capital allocation’. NBER Working Paper Series, pp.1-48. Web.

Mizik, T. (2020) ‘Impacts of international commodity trade on conventional biofuels production’. Sustainability, 12(7), p.2626. Web.

Moloi, T. and Marwala, T. (2020) Comparative advantage. In Artificial Intelligence in Economics and Finance Theories (pp. 21-32). Springer, Cham. Web.

Moon, B.E. (2018) Dilemmas of international trade. Routledge. Web.

Rodousakis, N. and Soklis, G. (2022) ‘The Impact of COVID-19 on the U.S.US Economy: The Multiplier Effects of Tourism’. Economies, 10(1), p.2. Web.

Pfitzinger, J., & Katzke, N. (2019). A constrained hierarchical risk parity algorithm with cluster-based capital allocation. Stellenbosch University, Department of Economics. Web.

Santacreu, A.M. and Zhu, H. (2018) Domestic innovation and international technology diffusion as sources of comparative advantage. Web.